India is fast becoming the Startup hub of the world.It has been raining startups in India for the past 3-4 years and has swept away all divides. From college graduates to working professionals, from salaried class to housewives, in metros, towns and villages, all are hopping on to the idea bandwagon.

People are trying their hands on every possible venture and business plan. NASSCOM has called India the fastest growing and the third largest startup ecosystem globally , with more than 3,100 currently in operation.

Gopal Modi, President, Investments, Orios Venture Partners. says” India is seeing high quality of entrepreneurs giving up large opportunity costs and it has never been witnessed before. This, combined with the Internet growth story, makes it a very attractive investment market,”.

The Startups today have various options to chose from when it comes to funding their venture, namely—venture capitalists, angel investors, incubators and banks. If we go by the numbers currently, the number of active investors in the country include 172 VCs, 43 angel investors and 48 incubators.

As much as $4.75 billion of VC funding came through in 2014 and it has already touched $3.18 billion in 2015. Flipkart made the biggest splash with its two rounds of $1.7 billion funding, the highest in 2014, according to Venture Intelligence and Tracxn!, two of the VC tracking firms.

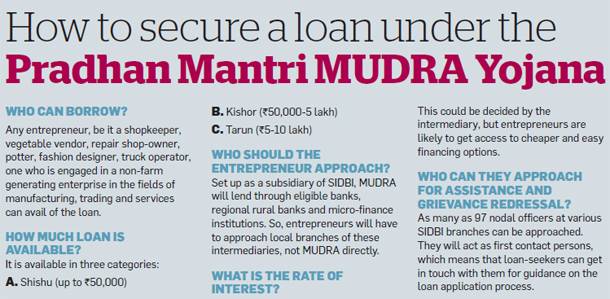

With the interventions of the Government of India, for instance,setting up the MUDRA Bank, which offer a corpus of Rs 20,000 crore for small and medium enterprises and the trade and venture development programs that the government is coming up with the business environment has become more conducive. Besides, various banks and finance companies have stepped up to encourage the trend.

Although this might encourage a lot of people to start thinking about Startups, but we must not forget that it takes a lot of struggle, sweat and tough negotiations that go into soliciting funds. Without a feasible business plan and working model, it is not easy to secure capital. Even if you do, keeping the venture afloat is difficult. It would be like building your structure on loose gravel.

We have tried to list down some options for the budding Startups to look for in case venture capital is a concern. Please read through to get an insight into the same.

VENTURE CAPITALISTS

As the saying goes “Money makes the mare go”, the same is true in business as well. For any project to begin and run it is very important to have the necessary funds.

Growth of a venture, requires big money and this is where venture capitalists come in, offering anywhere from Rs 1-300 crore in exchange for a high equity stake. It is one of the most high-profile and popular sources of funding for mid- to late-stage startups.

Given the scale of funds, it is not easy to secure these and entrepreneurs need to make elaborate preparations before approaching the VCs. “They should get some fundamentals in place,” says Modi of Orios Venture Partners. “This includes the right team mix, strong product backed by technology, and proven traction, especially in the case of new ideas where there are no proven models globally,” he adds.

Sulakshan Kumar and Sitakanta Ray, cofounders of price comparison e-commerce portal, MySmartPrice, got the pitch right since they managed to raise Rs 2 crore in 2011 and Rs 6 crore from Helion Ventures and Accel India in December 2013. “We zeroed in on top 7-8 VCs and finally approached Helion and Accel as they had invested in this industry,” says Kumar.

“Also, we had a base of 2 million users when we made the pitch. Nobody funds ideas, so you should have something to show, either traffic or revenue,” he adds. One also needs to present the current state of the company and team, as well as business plans for the next couple of years.

Startups usually skip the validation process by angels and incubators and approach VCs for small funding, so they are rejected.” When you finally meet the potential investors, be prepared to answer several questions. “What they are looking for is a clear vision for your company. They could ask you for a demonstration of your product as well,” says Kumar.

It is very important not to loose focus once you have the necessary funds. “It is important to remain equally committed to the business, innovate and evolve constantly, be alert to grasp new opportunities, adapt to changing environment and be open to communication,” says Banka of Equity Crest.

ADVANTAGES

- Ensures instant recognition for the firm.

- The backing of well-known VCs lends credibility, and

- Helps in attracting talent.

LIMITATIONS

- You can gain access to this option only after you have a well drafted plan in place, till then, you may have to fund ideas on your own.

- Those planning to start ventures while continuing with a job may find it difficult to raise funds through this process.

INCUBATORS & ACCELERATORS

As the name suggests, these setups incubate the pre-product idea. They precede the seed funding stage and help the entrepreneur develop a business idea or make a prototype by providing resources and services in exchange for an equity stake, which ranges from 2-10%. For entrepreneurs, this is a good take-off point because the survival rate of incubated companies is very high.

Incubators offer office space, administrative support, legal compliances, management training, mentoring and access to industry experts as well as to funding through angel investors or VCs.

“Barring a few incubators, most don’t offer funding, but make up for it by providing the entire logistics and external support so that the entrepreneur can focus on actual work without worrying about the nitty-gritty,” says Devashish Chakravarty, an IIM-Ahmedabad alumnus, and Director, Executive Search, QuezX.com, which provides recruitment for startups.

These are usually government-supported institutes like the IIMs or IITs, technical institutes or private business incubators run by industry veterans or companies.

The incubation period can be 2-3 years and admission is rigorous. One has to provide an application to such programmes and is accepted depending on the quality or feasibility of the idea, or other conditions specific to the institute.

The accelerators are mostly similar to incubators, but differ in that they help speed up and hone the business idea in short spans of 2-3 months. The focus is on intense mentoring, networking and building contacts, getting more investors, and helping with product development and marketing.

The admission process is also tougher and more competitive. GINSERV, IIM-Bangalore, NSRCEL, Microsoft Accelerator, IIT-Kanpur SIIC, etc are among the most sought after incubators and accelerators.

ADVANTAGES

- Offers quality advice and training,

- Facilitates funding, and

- Ensures a high survival rate for startups after receiving funds.

LIMITATIONS

- The startup often does not have much control over the VC or angel funding since incubators oversee the investors they meet.

How to avoid funding rejections?

Despite there being an ocean of online advice on securing funding for a startup, many budding entrepreneurs falter at the first step. Their ill-planned and half-baked approach gets them instant rejections. Follow these steps to ensure you don’t fail.

LOCATION OF THE INVESTOR

Make sure that the investor that you zero on is nearer to your area as getting funds from across the country is easy, but once you start operations, it will be easier for a local investor to monitor and add value, especially in the early stages.

INDUSTRY PREFERENCE OF THE INVESTOR

Every Venture Capitalist has his own area of interest where he wants to invest, hence, while shortlisting VCs or angel investors, find out their area of expertise or preference. Doing this can ensure that you get their approvals easily.

FUNDING STAGE

There are firms that provide funds only for a specific stage of a startup, be it the seed stage, growth phase or late stage development. So if you approach a VC, who backs a late-stage venture, when you require seed funding, a rejection is guaranteed.

FUND LIMIT

Individual investors or VCs may have caps or limits for funding. If you are looking for a bigger sum, putting in the effort to contact an angel with a low funding limit will be futile. So check for a funding match. In such cases, crowdfunding can also be helpful.

RESEARCH ABOUT THE INVESTOR

When you have zeroed in on a few firms, make sure you know everything about them—track record, promoters’ past, firms they have funded. Talk to people in the industry, check the Internet, scan their brochures. It is very important to understand how the investor’s track record has been to make sure that your venture runs smoothly.

HOW TO CONTACT

Seek an introduction via a credible intermediary, be it an entrepreneur they have funded, a reknowned professional who is a common acquaintance or former professors. Make sure you provide a proper briefing to the person.

HAVE YOU BUSINESS PLAN IN PLACE

This is the most critical step as investors get thousands of plans and rejection rate is high. So make a concise, error-free plan. List the idea, product, its growth potential, USP, existing market dynamics, team members and their calibre, completed product and beta customers.

PREPARE WELL FOR MEETING

If your plan passes muster and a meeting is set up, be prepared to answer all questions. Be precise, sure and ready to cover any aspect the investor may want to discuss.

ANGEL INVESTORS

The first stage of actual funding to get your idea off the workshop and into the market is called seed funding. The funds for this stage are usually secured by entrepreneurs from their own savings or loans from family and friends.

However, if you don’t have enough money, you can get it from other sources like angel investors or crowdfunding since not many investors and venture capitalists are willing to fund a concept that has not acquired critical mass or traction. Once it gains a semblance of market or customer base, you can approach VCs or banks for scaling up and expansion.

Angel investors are usually individuals or a group of industry professionals who are willing to fund your venture in return for an equity stake. The amounts can range from Rs 5 lakh to Rs 3 crore and are not as high as those provided by venture capitalists since the risk level at this stage is high.

Ankur Pegu and Sundeep Kapila of Mumbai-based healthcare startup, Swasth India, got their first external funding of Rs 2 crore from Ratan Tata via his firm, RNT Associates, last year. They founded the startup in 2008 and used their own savings till 2012, then borrowed from friends and family, and finally secured funding from Tata.

“Team, timing and potential market size are the three key things I look at in startups. The idea should be well-timed to take advantage of the ecosystem,” says Anupam Mittal, among the top 10 angel investors in India.

Other investors want to know whether the founders have the resilience, longevity and flexibility. “Be clear about the quantum of money you require, the returns you can offer, and indicate the exit route you can provide to investors, be it in the form of IPO or secondary sale,” says Pegu.

ADVANTAGES

- You are more likely to get funds from angel investors than VCs.

- They can be more flexible about your business plans, and

- Can offer better mentoring and advice.

LIMITATIONS

- You have to constantly make efforts to protect capital, which may cap the risks you can take.

- You need to offer a clear exit route, which can create uncertainty during bad phases.

CROWDFUNDING

This perhaps is a new age fund raising platform, which is slowly but steadily finding its foothold in India. The crowdfunding model is fueled by three types of actors: the project initiator who proposes the idea and/or project to be funded; individuals or groups who support the idea; and a moderating organization (the “platform”) that brings the parties together to launch the idea.

Entrepreneurs far from the reaches of India’s venture capital network now have an option to raise initial cash to develop products: “CrowdFunding”.

Although online platforms that help source funds from individuals are not new in India, players such as Wishberry, Ignite Intent and Milaap are focused mainly on creative projects and personal or social causes. They are now coming up with initiatives to fund start-ups as well.

CrowdFunding Models:

The Crowdfunding Centre’s May 2014 report identified the existence of two primary types of crowdfunding:

- Rewards Crowdfunding: entrepreneurs pre-sell a product or service to launch a business concept without incurring debt or sacrificing equity/shares.

- Equity Crowdfunding: the backer receives shares of a company, usually in its early stages, in exchange for the money pledged. The company’s success is determined by how successfully it can demonstrate its viability

One of the best crowdfunding success stories is that of Rohildev, founder and CEO of RHLvision Technologies, a company he founded in 2012 as a student of engineering, in Kerala.

For his Bluetooth ring, Fin, he managed to raise $2 million in 60 days, through 1,600 investors from 60-70 countries, on Indiegogo, a US-based crowdfunding platform that allows companies registered in any country to raise funds.

“The biggest problem with crowdfunding is that of regulation,” says QuezX’s Chakravarty. “If you are a private limited company, the number of members or investors can only go up to 200. If you exceed this number, you turn into a limited company and the compliance and paperwork that this entails can be dauntingly cumbersome.

The second issue is regarding the permission and compliance you need from all investors for every subsequent stage of funding that you will require. This can be extremely tedious for a startup,” he adds.

ADVANTAGES

- A quick source of raising funds, it helps entrepreneurs overcome the lack of network of friends or batchmates.

- It is simpler than other fund-raising options, and

- Could cut down on paperwork and numerous meetings.

LIMITATIONS

- It is not a simple question of submitting the proposal and getting funds. Startups need to carefully verify the websites where they can put up their requests since not all may be reliable.

- They need to be cautious while accepting funds from investors and check their sources of funding.

CGTMSE LOANS

CREDIT GUARANTEE TRUST FOR MICRO AND SMALL ENTERPRISES

The mere imagination of availing a loan from a Bank or Government scheme might sound like a scary affair due to the paperwork and delays associated.

This often turns off the grittiest of entrepreneurs. However, under the Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) scheme, meant to encourage entrepreneurs, one can get loans of up to Rs 1 crore without collateral or surety.

This is the reason Fizzy Foodlabs cofounders— Nipun Katyal, Manish Tirthani and Varun Jhawar—approached Dena Bank for a loan under the scheme two years ago.

For their ready-to-cook global cuisine venture under the brand, Chef’s Basket, the IITBombay graduates started with a seed fund of Rs 15 lakh from their own savings, while another Rs 50 lakh came from friends. “However, in the FMCG space, working capital is a big requirement.

We did not want to take risky capital and, hence, went for the `1 crore CGTMSE loan that was offered at 14% interest,” says Katyal.After submitting the project report, the bank got in touch with them for a few rounds of queries and inspection, after which the loan was approved.

ADVANTAGES

- It is a simpler route for entrepreneurs who may not boast a good network of friends or the IIT/IIM pedigree to tap VC funding.

- The loan is offered without collateral, so it is easier for the service sector startups to borrow.

LIMITATIONS

- Paperwork and time-consuming process could be a challenge.

- The maximum loan is Rs 1 crore, so its use could be limited to working capital.

NEW SEBI NORMS: HOW STARTUPS BENEFIT

WHAT’S NEW

A dedicated Institutional Trading Platform (ITP) will be set up on domestic stock exchanges to list startups from new sectors.

WHY IS IT GOOD?

In the absence of such facility, the startups had to move overseas to list themselves on stock exchanges. Now they can raise capital and list in India itself.

WHAT’S NEW

The Application Supported by Blocked Amount (ASBA) will be applicable to all investor categories and IPOs.

WHY IS IT GOOD?

With the increase in bank branches with ASBA facility, all applications can be supported by ASBA. This means investors won’t suffer loss of interest and refund will not be a problem.

WHAT’S NEW

Rs 10 lakh will be the minimum investment required for startups and small retailers will not be able to invest.

WHY IS IT GOOD?

Startups don’t have a profitability track record and investing in them entails risk. Also, small investors may not be able to understand the business models.

WHAT’S NEW

Six months will be the new minimum lock-in period for promoters and prelisting investors, cut from three years.

WHY IS IT GOOD?

This has been relaxed as there is no promoter concept in startups.

WHAT’S NEW

Relaxation in provisions related to disclosures and allocation.

WHY IS IT GOOD?

It will move the IPO process closer to global standards and help firms consider an India listing over international listing.

WHAT’S NEW

Startups can list within six days of IPO, instead of 12 days earlier.

WHY IS IT GOOD?

The funds will not remain locked in for a longer period and help reduce the costs associated with the public offering.

BANKS & NBFCs

While VC and angel funding are more popular, conventional loans from banks and non-banking financial companies (NBFCs) continue to help grow small businesses.

They help finance the purchase of inventory and equipment, besides securing operating capital and funds for expansion. More importantly, unlike a VC or angel, which have an equity stake, banks do not seek ownership in your venture.

They also don’t get involved in the business and won’t bother you if you use the loan for the purpose for which it was taken. Take the case of Mumbai-based Shree Ganesh Graphics’ Ganesh Kini, who has been tapping Syndicate Bank for working capital needs since 2011.

He started his business of printing visiting cards, brochures and receipt books for SME vendors, in 2007, and did well enough to have the bank sanction an overdraft facility of Rs 10 lakh in 2011. Last year, his overdraft limit was raised to Rs 35 lakh.

If you are still interested, approach the bank only if you have a good track record and prepare a detailed project report. According to V.N. Kulkarni, former banker and now the Chief Credit Counsellor with Bank of Indiabacked Abhay Credit Counselling Centre, a project report should comprise introduction, executive summary, details of all aspects of the project and a conclusion.

ADVANTAGES

- Unlike VCs which can be selective, these loans are for anyone with a viable business model.

LIMITATIONS

- Collateral may not be easy to furnish.

- Not only do you pay interest on loan but it also has to be done on time irrespective of how your business is faring.

- They also entail a lot of paperwork

Some interesting facts about startups:

3,100: The total number of startups in India

3rd: India’s ranking in the world in startups after the US and the European Union.

Bengaluru: The city where most of the funded startups are based, followed by New Delhi and Mumbai.

690: The total number of funding deals that took place across 566 tech startups in India in 2014-15.

$1.7 billion: Flipkart got the highest funding in India in 2014, followed by Snapdeal at $637 million and Ola at $250 million.$3.1 billion: The venture capital funding to startups in India till date in 2015.