Ratan Naval Tata (born 28 December 1937) is an Indian businessman, investor, philanthropist and chairman Emeritus of Tata Sons. He was the chairman of Tata Group, a Mumbai-based conglomerate from 1991–2012.

He stepped down as the chairman of Tata Group, on 28 December 2012 but continues as the chairman of the Group’s charitable trusts. At the age of 77 Ratan Tata still continues to take a keen interest in the business developments happening around him.

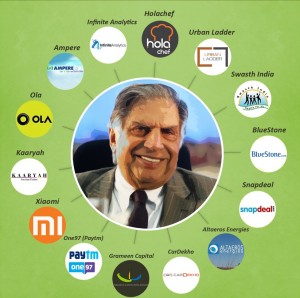

Since stepping down from day-to-day responsibilities at the Tata Group, Ratan Tata has notched up 10 investments in startups. Like the conglomerate, Tata’s personal investment portfolio is also spread across India’s hottest dotcoms, affordable healthcare and clean energy. The investments are typically between Rs 1-5 crore. He has so far invested in 14 major Startups.

We have tried to enlist them for you:

- Hola Chef: Ratan Tata has made a personal investment of an undisclosed amount in the online marketplace for chefs Holachef. Launched in September 2014 by Saurabh Saxena and Anil Gelra, Holachef has seen substantial growth in Mumbai and Pune.

- Urban Ladder: Ratan Tata has invested in online furniture company Urban Ladder. Launched in July 2012, Urban Ladder was co-founded by Ashish Goel and Rajiv Srivatsa. It offers over 1,000 products across 25 categories in furniture such as wardrobes, beds, sofas, dining tables and coffee tables.

- Swasth India: “The Swasth India Foundation”. Founded in 2008 by 2 IITians with more than 14 years of combined experience in McKinsey and KPMG, its aim was to create integrated health schemes covering – OPD consultation, drugs, lab tests, cashless hospitalisation and preventative / promotive health. Swasth India Services Private Limited was built with a view to create a social business working towards improving the health of low-income segments in both urban and rural India. Ratan Tata Invested Rs 2 crore in December 2014.

- Bluestone: BlueStone is an online jewellery store that houses high quality jewellery and accessories with strikingly exquisite designs. With its affordable rates and unique shopping experience, BlueStone is your one stop destination for making any given day an occasion. Bluestone was valued at Rs 135 crore when it raised funding from Kalaari Capital, when Tata also co-invested. The Bengaluru-based startup is currently in talks to raise another $20 million.

- Snapdeal: Snapdeal is an online marketplace, New Delhi, India. The company was started by, a Wharton graduate as part of the dual degree M&T Engineering and Business program at Penn, and Rohit Bansal, an alumnus of IIT Delhi in February 2010. Tata is believed to have invested less than Rs 5 crore, buying 256 shares from Snapdeal’s angel investors including Kenneth Glass. Snapdeal was valued at $1 billion before Ratan Tata invested. The valuation has increased to $5 billion now .

- Altaeros Energies: Altaeros Energies World’s First Commercial Airborne Wind Turbine. Altaeros Energies was launched in 2010 with a simple mission of deploying the world’s first commercial airborne wind turbine, harnessing the abundant energy in strong, steady winds at higher altitudes. Altaeros recently received additional funding from RNT Associates International Pte Limited, a company owned and controlled by Mr. Ratan N Tata, former Chairman of the Tata Group. Tata Power, a Tata Group subsidiary, is the leading developer of wind energy projects in India.

- CarDekho: CarDekho, a website that goes way beyond the boundaries of facts and figures in its exploration of the glamorous and exotic world of cars, providing complete freedom to the car-fanatics of India to watch, know and understand the deepest passion of their lives in much greater detail and from a wide variety of viewpoints.Sections like Used Cars, Sell Cars, Loan, Insurance and Dealers together constitute an extensive network of individual buyers and sellers, dealers, and insurance and loan providers, assembling every element of car trade at one place to make the entire process unbelievably simple. Ratan Tata has invested in his personal capacity in auto classifieds portal CarDekho.com. Mr Tata, an auto enthusiast, has agreed to advise the company as and when required.

- Grameen Capital: The Mumbai-based investment advisory company focuses on the impact investments space, ranging from microfi nance companies to education and healthcare venture catering to the bottom-of-the-pyramid segment. Tata, along with mining tycoon Shrinivas Dempo and investment banker Vikram Gandhi, picked up equity in the NBFC which will lend to social enterprises. Ratan Tata bought a minority stake in the company in March 2015 by investing into the company.

- One97: The Noida-based company has successfully transitioned from a value-added services player to an online wallet Paytm, which it says now has 80 million accounts. The company is now moving into etailing as it looks to compete with Flipkart and Snapdeal. Before Ratan Tata’s investment was announced, One97 said it had raised $575 million from Alibaba’s affiliate, Alipay. The company is in talks to raise another round of funding.

- Xiomi: The Chinese smartphone maker launched in India last year, with its product becoming an instant hit in the market, with inventory running out in minutes. Founded by serial entrepreneur Lei Jun, Xiaomi is said to have recorded sales of $12 billion in 2014. Ratan Tata invested in the company in April 2015.

- Kaaryah: Ratan Tata’s latest investment is a women’s non-casual wear, which has been founded by former Honeywell director of strategy Nidhi Agarwal Kashyap. The investment into Kaaryah was made by Ratan Tata in 2015.

- Ola: The Indian Taxi conglomerate saw investments from Ratan Tata in July 2015. Ratan Tata, chairman emeritus of Tata Sons, has invested in taxi firm Ola in his personal capacity.

- Ampere: Ratan Tata has invested an undisclosed amount in Ampere, a Coimbatore-based electric vehicle start-up founded by a woman entrepreneur in July 2015.Mr. Tata made the investment along with Ampere’s existing investor, Forum Synergies. The start-up, founded by Hemalatha Annamalai, will use the funds to scale up operations and hire talent over two years.

- Infinite analytics: Infinite Analytics, a Mumbai and Boston-based data analytics firm, has raised an undisclosed bridge round of funding from Ratan Tata to expand its predictive analytics technology to segments beyond retail and ecommerce.

With his business acumen, we are definitely headed towards more such investments in future.